First Time Builder

First Home Owners’ Grant Queensland: The Ultimate Guide

Cash is almost always a consideration when buying your own home for the first time. To help first-time buyers purchase a property, the Queensland government offers a First Home Owners’ Grant, and from the 20th of November 2023 to the 30th of June 2025, the grant will double in value from $15,000 to $30,0000. The grant is available when purchasing a new-build property or on the cost of building a new home. First homeowners are expected to be able to apply for the increased grant starting the first week of January 2024.

If you’re about to take the plunge into the property market, read on to discover if you’re eligible for this scheme.

Quick Links

About the First Home Owners’ Grant

If you are a first-time home buyer purchasing a new-build property (i.e. one that has yet to be bought or lived in before) or building your own property, you may be eligible for a one-off grant of $30,000 from the Queensland government

How much is the First Home Owners’ Grant in QLD?

As of November 2023, the current value of the First Home Owners’ Grant for Queensland properties is $30,000.

Home Owners Grant Eligibility

What would make me ineligible for the First Home Owners’ Grant?

To be eligible for a first home grant, you need to fulfil the following criteria:

- You must purchase a new home, unit duplex, townhouse or a granny flat built on a relative’s land. This means one that hasn’t been lived in before or sold as a place to live. The total value of the home and land must be less than $750,000. Existing properties may be eligible in some cases, provided they have been extensively renovated, refurbished or altered to provide suitable living space.

- House and land packages are eligible if you meet the other eligibility criteria.

- You must be over 18 years old.

- In most cases, you must be an Australian citizen, have a permanent visa or be part of a joint First Home Owners’ Grant application along with an Australian citizen. New Zealand nationals with a particular category visa may also be eligible in some circumstances.

- You (or the other person in the case of a joint application) must not have owned a home previously.

- You have not received a First Home Owners’ Grant previously.

There are other exceptions and criteria relating to particular circumstances when a grant may not be awarded. Further information about these specifics can be found here.

The grant is not available to purchase investment properties.

If you satisfy these criteria, the next step is to fill in the first home buyers grant application form to start the process for consideration and approval.

Applying for the First Home Owners’ Grant

How do I apply for the First Home Owners’ Grant?

First, you must complete and submit the first home owner’s grant application form. There are two ways to apply: either through an approved agent (a bank or lending institution) or to the Queensland Revenue Office. The fastest way to receive the grant is by applying through an approved agent, as applications through the QRO won’t be paid until the home is complete.

You must also provide supporting documents for the grant within the following timeframes:

- Buying your home—you must apply within 1 year of taking possession of the new home and your title being registered.

- Contract to build—you must apply within 1 year of the new home being completed, for instance, the final inspection certificate being issued.

- Owner–builder—you must apply within 1 year of the new home being completed; for instance, the final inspection certificate being issued.

FAQs

Is the First Home Owners’ Grant still available in QLD?

Yes! Government grants for first time home buyers are still available in Queensland.From November 2023-2025, the grant has been set as a one-off payment of $30,000. The grant is only on offer to first time home buyers and is only available for the purchase of new-build properties or for people who are building their own property (or contracting with a builder to do it on their behalf).

When does the First Home Owners’ Grant end in QLD?

At the time of writing, there are no plans by the Queensland government to end the first-time home buyer grants. The current grant amount is set to change on the 30th of June 2025.

For first-time buyers who are looking to buy a pre-existing home (one that’s been occupied before or which isn’t a new-build), the first home buyers grant Qld stamp duty relief applies. This enables first-time buyers to enjoy relief of up to $8,750 on their stamp duty provided the cost of the property is below $500,000. First-time homeowners who are choosing to build their own property can take advantage of both stamp duty relief up to $7,150 on their land purchase (provided the value of the land is less than $250,000 and the first-time buyers home grant).

Does the First Home Owners’ Grant count towards a deposit?

The first home buyers grant money can be used for a deposit. That said, because the grant is not normally handed across until the transaction is complete, you may well need to find the money up-front to cover the deposit in order to satisfy the requirements of your lending agent. Different home loan providers have different criteria: some may accept proof of your eligibility for a grant as sufficient guarantee that you will be able to pay the deposit, others may not.

Can you use the First Home Owners’ Grant to buy land?

No. Although people looking to build their own property on land can get stamp duty relief (up to a maximum of $47,175 on land which costs less than $250,000.

Can you get the First Home Owners’ Grant if you’re married?

Marriage in itself is not a barrier to the First Home Owners’ Grant application being successful. That said, if your spouse does not meet the criteria for the grant, then it may not be awarded.

Can permanent residents get the First Home Owners’ Grant?

Yes! Provided permanent Australian residents satisfy all the other criteria for the First Home Owners’ Grant, then they should be eligible to apply. Note that temporary visas or similar mean that you would be ineligible for a Queensland First Home Owners’ Grant.

Can you get the First Home Owners’ Grant twice?

No. The First Home Owners’ Grant is only available once. This affects both single and joint applications. Even if you no longer live or have an interest in the property purchased using the home owners grant, you are still ineligible to apply for another one. Similarly, if you used a home owners grant to build your own home, you then can’t claim a further grant should you sell the home you built and attempt to purchase another one.

Do first home buyers pay stamp duty in Qld?

First home buyers can enjoy stamp duty relief whether they are eligible for a first home buyers grant or not. Stamp duty relief for first-time buyers applies to both new-build home purchases and existing buildings. Stamp duty relief is also available on land purchases, where the land is being used to build a new-build property.

Total stamp duty relief is only available on first-time purchases if the value of the purchase is below $500,000. Properties which cost more than this will incur further stamp duty, irrespective of whether they are a first purchase or not. When it comes to land, the land must be worth less than $250,000 for full stamp duty relief to apply. Above that amount and the rebate will not cover the full cost of the stamp duty which needs to be paid.

Can you get First Home Owners’ Grant on existing homes?

Generally, the answer to this question is no. The vast majority of First Home Owners’ Grants are given out to people who are buying a new-build property for the first time or who are building their own property for the first time. In some circumstances, a grant can be awarded on an existing home, where extensive refurbishment or remodelling has taken place to make the dwelling fit for habitation. These are judged on a case by case basis.

When does the First Home Owners’ Grant get paid to successful applicants?

The new home owners grant is paid across at different points in the purchasing transaction, depending on whether your new home owners grant is for a new-build constructed by a developer or whether you are building your own property (or having it built for you by a builder as a one-off project).

For a first time new-build purchase from a developer, the grant is paid on completion of the sale.

If you are building your own property, the government grant for first home buyers is paid across once construction has actually begun on site.

Home Designs for First Home Buyers

Here at G.J. Gardner Homes, we are known for our quality home designs created to suit your unique lifestyle. From acreage to narrow blocks, our home designs are created to get the most out of your block of land, with everything from natural lighting to north-facing orientation kept in mind during the design process. Check out a just a few of our favourite first home buyer home designs below.

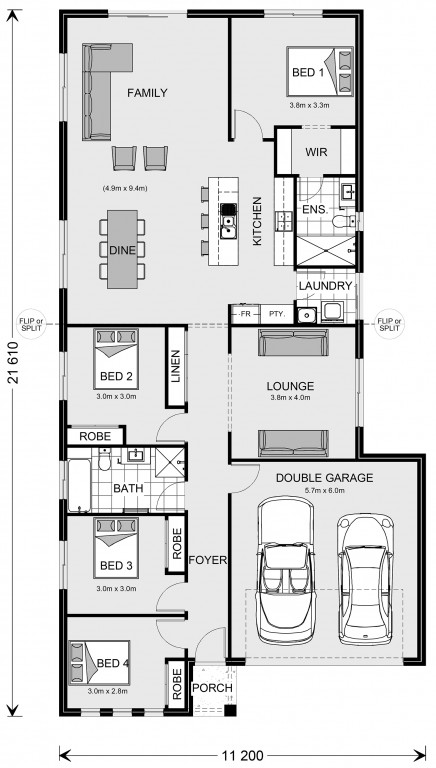

Edgecliff 207

Broadwater 283

Kuranda 289

Check out more home designs, ideal for first home owners here.

The information contained in this article is not legal or financial advice and should not be relied upon as a substitute for professional advice. Consumers should make their own independent inquiries and consider the need to obtain any professional advice relevant to their circumstances. Further information is available at http://www.firsthome.gov.au/ and https://www.nhfic.gov.au/what-we-do/fhlds.