Cost to Build

The 2021 Federal Budget – What does it mean for home builders?

First home buyers, downsizers and single parents were among some of the winners of the 2021 Federal Budget. Treasurer Frydenberg’s Federal Budget 2021-22 commits to “supporting construction jobs” and includes multiple grants and schemes aimed at “helping more Australians realise their goal of homeownership”.

In his speech to parliament, the Treasurer stated that while last year’s HomeBuilder Scheme had been a success so far, “in this budget, our housing measures go even further”.

The schemes included the introduction of the Family Home Guarantee, an extension of the New Home Guarantee, the strengthening of the First Home Super Saver Scheme and an extension of the HomeBuilder program,

Read more to determine how the new and extended schemes could help you on your homeowner’s journey.

Extension of the First Home Super Saver Scheme

Initially introduced by the Australian Government in the 2017-18 Federal Budget, the First Home Super Saver (FHSS) aims to reduce pressure on housing affordability.

Since the scheme was initially introduced, first home buyers have been able to make voluntary contributions of up to $30,000 to their super fund. They can withdraw this amount (plus earnings, less tax) to help with a deposit on their first home.

However, in the 2021 Budget, the scheme was amended to allow first home buyers to save for a deposit faster through their superannuation. From 1 July 2022, first home buyers can make voluntary super contributions of up to $50,000.

With average property prices increasing across Australia, the increase of voluntary contributions reflects the changing market.

Am I Eligible for the FHSS?

To be eligible for the FHSS, you must be a first home buyer, and you must also:

- Live in the premises you are buying, or intend to as soon as practicable.

- You intend to live in the property for at least six months within the first 12 months you own it after it is practical to move in.

To find out more about the scheme, your eligibility and how you can save in your super, check out the ATO’ guide to the FHSS.

10,000 New Spots Added to the First Home Loan Deposit Scheme

From July 1st 2021, an additional 10,000 places will be released to first home buyers to buy a new or existing home as an expansion of the First Home Loan Deposit Scheme’s new home program, the New Home Guarantee.

The FHLD scheme allows eligible first home buyers to build a new home or purchase a newly constructed property with a deposit of just 5%. The government acts as a guarantor for the remaining 15%.

Am I Eligible for the First Home Loan Scheme

Both singles and couples are eligible to apply for the scheme. However, there are several criteria that you need to pass to determine your eligibility, including :

- an income test

- a prior property ownership test

- a minimum age test

- a deposit requirement, and

- an owner-occupier requirement.

Take the eligibility test for the First Home Loan Deposit Scheme here.

Family Home Guarentee

With property prices forecasted to increase by up to 17% through 2021 across the nation, as reported by the ANZ Bank, entering the property marketing is becoming harder, especially for single parent homes.

With the Family Home Guarentee grant, the Government plans to help alleviate one of the biggest barriers to entry for single parents, putting together a home deposit.

Within the program, single parents will now be able to access a Family Home Guarantee which will allow 10,000 applicants over four years eligible to purchase a home with as little as 2% deposit. This would see the government act as a guarantor on the loan, therefore removing the need for lenders mortgage insurance (LMI).

The Family Home Guarentee extends to both new and existing homes, and isn’t limited to first home buyers.

Extending Access to The Downsizer Contribution

With the goal of freeing up more homes for first time buyers and families, the government has extended and altered the requirements for downsizer contributions.

Treasurer Frydenberg announced that from 1 July 2022, the minimum age for the downsizer contribution will be lowered from 65 to 60, allowing Australians nearing retirement to make a post-tax contribution of up to $300,000 per person, or $600,000 per couple when they sell their family home.

Budget papers stated that “this will provide greater flexibility for people to contribute to their superannuation and to access their housing wealth”. So far, around 22,000 Australians have already made downsizer contributions under the existing rules.

12 Month Extension of HomeBuilder

In the 2021 Budget, the Federal Government announced an extension of the popular HomeBuilder program to give people who have already applied an extra 12 months to start their renovations or builds.

HomeBuilder was introduced to boost the private construction sector and to motivate people to significantly renovate existing homes or build new houses.

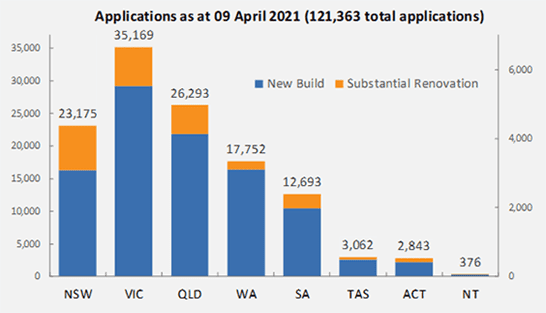

The HomeBuilder initiative had over 121,363 applications as of its close date in April 2021.

To find out more about the HomeBuilder grant or get in touch with your relevant state about your HomeBuilder application, head to https://treasury.gov.au/coronavirus/homebuilder.