First Time Builder

First Home Owners’ Grant South Australia: What You Need to Know

Are you a first-time home buyer struggling to get onto the property ladder? If so, you’re not alone. But thanks to the government grant for first home buyers (aka the first home buyers’ grant), you can realise the great Australian dream sooner.

This article walks you through the two main methods of financial support available to South Australians: the First Home Owners’ Grant and the 2020 First Home Loan Deposit Scheme, how much it’s worth in South Australia, and answers some of your most common questions.

Quick Links

About the First Home Owners’ Grant

What is the First Home Owners’ Grant?

Introduced in 2000, these nation-wide government grants for first home buyers were designed to offset the GST, and help first home buyers enter the property market sooner. This one-time first home grant is available for South Australian buyers to either build or purchase a home.

How does the First Home Owners’ Grant work?

Under the scheme, first-time home buyers (individuals or couples) can apply for a single payment of $15,000.

This grant money can contribute to the cost of either purchasing or building a new home in South Australia. To help you enter your first home sooner, this money can be put towards a deposit for either purchasing or building a new home.

According to current South Australian rules, the house you purchase or build must be worth $575,000 or less. And, as the new home owners’ grant isn’t means tested, your eligibility does not depend on your income.

How much is the First Home Owners’ Grant in SA?

In 2020, the first home owners’ grant SA entitles you to $15,000 to put towards a new residential dwelling (valued at a total of $575,000).

To access the new home owners’ grant, you must live in the property for a minimum of six months within the first year of purchase.

When does the First Home Owners’ Grant get paid to successful applicants?

When you receive the grant depends entirely on the type of property you plan to build or purchase. If you are purchasing a new home, the grant is released upon the settlement of your new home. This means it can count towards your deposit.

If you’re building a home, however, the rules are slightly different. When building a home, you need to settle the block of land. Then, you have to pay your builder a 5% deposit for building approval and council approval. And, after the deposit is paid and construction has begun, the $15,000 grant will be paid.

Eligibility

Do I qualify for the First Home Owners’ Grant?

First home buyers are considered eligible to receive the South Australia first home buyers grant if you meet the following criteria:

- If yourself or your partner is an Australian resident or has permanent residency

- You haven’t previously owned a residential property in Australia on or after July 1st, 2000.

- The newly built or purchased home must be your primary residence for at least six consecutive months (within 1 year of completion)

- You must be a natural person (i.e. not a company or trustee)

- You must be at least 18 years old when applying for the new home owners’ grant

- The home must be valued at $575,000 or less (including the building contract and land value), and;

- The property must be a “new home”. That is, it must be a new, fixed dwelling which is suitable to reside in (i.e. single dwelling, flat, duplex or townhouse)

What would make me ineligible for the First Home Owners’ Grant?

There are certain circumstances in which you may be ineligible to receive the First home buyers grant Australia, including:

- Previous home ownership

- The type of property you purchase – to be eligible, you must purchase or build a new home

- Not living in the home for at least six consecutive months within the first year of purchase

- If you are under 18, and;

- If you are not an Australian citizen or permanent resident

Applying for the First Home Owners’ Grant

How do I apply for the First Home Owners’ Grant?

There are two ways to apply for the first home owners’ grant SA. You can either apply through:

- An approved bank or lender, or;

- The South Australia Office of State Revenue

Applying through bank/lender – this is the best way to receive grant funds as soon as possible. To apply, simply take your completed first home owners’ grant application form, along with supporting documentation (include the signed home building or buying contract) to an approved bank or lending institution. Generally, applications are processed in 10 working days or less.

Applying through Office of State Revenue – lodge in person or post your completed first home owners’ grant application and supporting documents (including a signed home building or buying contract) to the South Australian Office of State Revenue. When received, most applications are processed within 10 working days.

When should I apply for the First Home Owners’ Grant?

There are strict timeframes in which you must apply for the new home owners’ grant. These timeframes depend on whether you are:

- Buying a home – You have to apply within 12 months of purchasing your new home and registering the title.

- Contract to build – You must apply within one year of the home being completed (i.e. the issuing of the final inspection certificate). Or;

- Owner-builder – You have to apply within 12 months of the home’s completion (i.e. within one year of the final inspection certificate being issued).

If you can’t meet these deadlines, however, extensions may be granted. If you’re applying for the grant outside of the application period, you need to include a note explaining your circumstances along with your first home owners grant application.

FAQs

Is the First Home Buyers’ Grant still available in SA?

Yes, it is. If you’re planning to build or purchase your first home, the South Australia first home buyers’ grant is just the jumpstart you’ve been looking for. You can still access the $15,000 new home owners’ grant if you have signed either:

- A contract to purchase a new home, or;

- A contract to build a new home (from July 1st, 2018).

However, if you signed either of the above contracts of sale between July 1st, 2016 and June 30th, 2018, you are eligible for the South Australia first home buyers’ grant. This first home grant is valued at $20,000.

When does the First Home Owners’ Grant end in SA?

At the moment, there is no end date for the $15,000 first home buyers’ grant. Although, the previous stamp duty concessions are no longer available, and you can no longer use the grant to buy vacant land.

Does the First Home Owners’ Grant count towards a deposit?

Yes, it absolutely does. The fantastic thing about the first home grant is it enables you to build or purchase your first home sooner. Get onto the property ladder faster by using the grant to boost your deposit.

The only caveat is that not all banks consider the first home buyer grant to be genuine savings. Having said that, many banks do accept the grant as part of your deposit. So, you could be moving into your new home sooner than you thought.

Can you use the First Home Buyers’ Grant to buy land?

No, the grant cannot be used to purchase land.

Can you get the First Home Owners’ Grant if you’re married?

Yes, provided you and your spouse meet certain conditions. Before applying for any first-time home buyer grants, you need to be absolutely clear on the status of your relationship. According to the South Australian Office of State Revenue, you are considered “partners” if you have been together for two years or more.

If you meet this requirement, you and your spouse are eligible for the $15,000 first home buyers’ grant.

Can permanent residents get the First Home Owners’ Grant?

Yes, they absolutely can. If you are a permanent resident (or hold a New Zealand visa), you are eligible to receive the first home grant. You are also eligible if you are applying with someone who holds permanent residency or a New Zealand visa.

Can you get the First Home Owners’ Grant twice?

No, this is not possible. The first home buyers’ grant Australia is a one-time payment of $15,000. As such, individuals and couples can only receive it once.

Do first home buyers pay stamp duty in SA?

Yes. Stamp duty – a tax on the transfer or sale of land – is one of the biggest hurdles for first home buyers. The amount varies, depending on the area you’re buying in and the type of property you’re buying (i.e. home, off-the-plan apartment, etc.)

Increasing along with house prices, the average stamp duty for a $575,000 house is $25,455.

About The 2020 First Home Loan Deposit Scheme

The 2020 First Home Loan Deposit Scheme is due to commence on the 1st of January 2020. The scheme allows first home buyers with just a 5% deposit to take out a mortgage with significantly lower fees.

Banks and lenders usually require purchasers to have 20% of the property’s value saved already to be exempt from fees relating to Lender’s Mortgage Insurance (LMI). If you don’t have this much saved up they will take out insurance policies on your loan in case you cannot pay it back, which results in extra fees for you.

The way the scheme works is the government will underwrite the loan so that LMI does not apply. The scheme means that the federal government acts as your guarantor, making it easier to be approved for a home loan with lower fees without having saved as much money.

In South Australia the cap for capital cities and regional centres is $400,000, with the rest of the state being limited to $200,000. Read more about this national scheme here.

Home Designs for First Home Buyers

Here at G.J. Gardner Homes, we are known for our quality home designs created to suit your unique lifestyle. From acreage to narrow blocks, our home designs are created to get the most out of your block of land, with everything from natural lighting to north-facing orientation kept in mind during the design process. Check out a just a few of our favourite first home buyer home designs below.

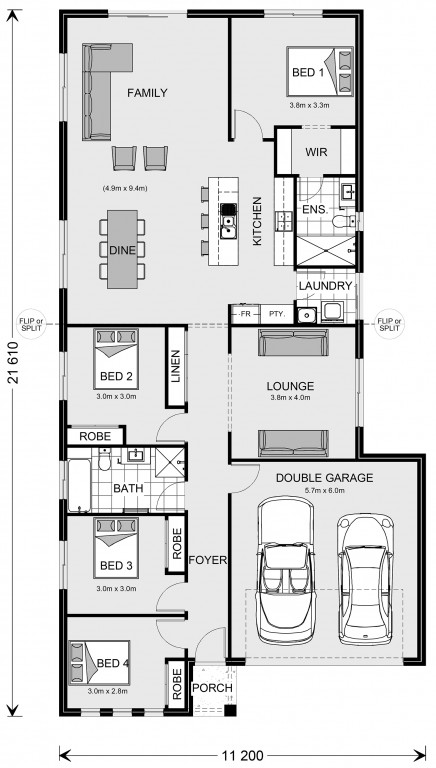

Edgecliff 207

Broadwater 283

Kuranda 289

Check out more home designs, ideal for first home owners here.

The information contained in this article is not legal or financial advice and should not be relied upon as a substitute for professional advice. Consumers should make their own independent inquiries and consider the need to obtain any professional advice relevant to their circumstances. Further information is available at http://www.firsthome.gov.au/ and https://www.nhfic.gov.au/what-we-do/fhlds.