First Time Builder

First Home Owners’ Grant Western Australia

When it comes to purchasing a residential property in Western Australia (WA), affordability is a major consideration. This is especially true for first-time buyers. Saving for a deposit and financing subsequent home loan repayments or construction costs can be a challenge.

The government recognises this and has put in place a number of different grants, tax rebates and other initiatives to help make the home buying process more accessible. The government is also committed to easing housing supply problems (which may lead to inflated prices for first-time buyers). This is why many schemes to help first-time buyers are related to the purchase or construction of new-build properties, rather than an existing property.

There are four schemes in total available to Western Australians, with the potential to be eligible for up to $70k of government assistance to build your first home.

Quick Links

- About the First Home Owners’ grant

- About The HomeBuilder Grant program

- About The 2020 Building Bonus grant

- About The 2020 First Home Loan deposit scheme

About the First Home Owners’ Grant

The First Home Owners’ Grant offers first time buyers the opportunity to enjoy a welcome financial boost when it comes to the purchase of a new-build property. Although not an enormous amount of money, $10,000 can be enough to tip the balance in favour of a home purchase. Particularly if used in conjunction with some of the other benefits which developers offer to first-time buyers (for example access to low-cost home loans, partial deposit payments etc), it can make property ownership a more attractive and more realistic option.

If you are considering property ownership for the first time, it is important to weigh up all the options that are available to you (including the purchase of an existing property) and make the decision that’s right for you. In some cases, even with the inducement of a first home owners’ grant, it may be more financially prudent to purchase an existing property.

How Does The First Home Owners Grant Work?

The first home grant is a set amount of money which the government pays across to eligible WA residents as part payment towards their first home purchase. To apply for a first home buyers’ grant Western Australian residents need to be purchasing a brand new property. This can be a property that they are purchasing from a developer, or one which they have commissioned to be built by a contractor (or are building themselves).

Can you get first home owners grant on existing homes?

Yes, although there are some stipulations. The list of eligible transactions under the first home owners’ grant in WA include purchases of new homes, comprehensive home building contracts and owner-builder agreements. You may be eligible for the grant if you are purchasing a new home that has not been lived in, are building a new home or are an owner-builder.

How Much is the First Home Owners Grant in WA?

The grant is currently set at $10,000. Note that the grant is only available for properties of a certain value.

South of the 26th Parallel, the purchase / construction must be less than $750,000 to qualify for a grant. North of the 26th Parallel, the purchase / construction must be less than $1,000,000 to qualify for a grant.

Eligibility

What would make me ineligible for the First Home Owners Grant?

To be successful in your application for government grants for first time buyers, you will need to satisfy the following criteria::

- Be an Australian resident (or have permanent leave to remain). For joint applications, one party needs to be a permanent Australian resident, but there is some flexibility for the other party involved.

- Be over 18, but under-18s can apply for an exemption.

- Not have owned a property in Australia before.

- Be purchasing a new-build property or building a property to live in.

- Move into the property within 12 months of receiving the grant and live in it for at least 6 months afterwards.

Applying

How do I apply for the First Home Owners Grant?

If you are confident that you satisfy the eligibility criteria, the next thing to do is to fill in the first home buyers grant application form. This can be found here. Your application will then be assessed with a view to deciding if you are eligible to receive the grant.

FAQS

Is the First Home Owners Grant still available in WA?

Yes, the $10,000 government grant for first home buyers is still currently available. In some circumstances it may be possible to apply retrospectively for an additional “boost” of $5,000. The criteria for a retrospective boost are summarised here.

When does the First Home Owners Grant end in WA?

At the moment there isn’t a specific end date planned. That said, there’s no guarantee that the current level of grant will be maintained in the future. Some states have already dropped their grant rate: year-on-year grant levels are dependent on what’s available when the government sets its spending budget. We suggest that if you have identified a property, you apply promptly to avoid missing out.

Does the First Home Owners Grant count towards a deposit?

It can do! It’s worth remembering that in most cases government grants for first time buyers are paid across once the sales transaction has been completed. Because home loan lenders often wish to see that the deposit is readily available before approving the loan required to complete the purchase, they may be reluctant to lend if part of the deposit isn’t physically in your bank account. Other lenders are happy with proof of indicative approval from the government. Speak to your lender regarding their position on using first time home buyer grants as whole or part of a deposit.

Can you use the First Home Owners Grant to buy land?

No. Although the grant can be used towards a “home and land package”, it can’t be used towards the purchase of land alone. That said, if the land is being bought for the purposes of building a property, you can obtain stamp duty relief on a sliding scale, depending on the land value: for land that costs $300,000 or less, full stamp duty relief is available.

Can you get the First Home Owners Grant if you’re married?

Married couples are eligible to apply for the grant, provided they satisfy the requirements.

Can permanent residents get First Home Owners Grant?

It is a requirement of receiving the grant that lone applicants, or at least one person in a joint application, is a permanent Australian resident.

Can you get the First Home Owners Grant twice?

No. It’s not usually possible to be given the grant twice.

Do first home buyers pay stamp duty in WA?

In some circumstances, yes. First time home buyers grant Western Australia stamp duty relief is provided on a sliding scale. Properties which cost $430,000 or less qualify for a full stamp duty rebate. For homes which cost more than this, conveyancing tax (also known as stamp duty or transfer duty) is payable on a sliding scale, rising as the purchase price increases. Note the maximum property values to qualify for the first home grant: it’s possible to be eligible for the grant at the same time as needing to pay some stamp duty.

When Does the First Home Owners Grant get paid to successful applicants?

The first home buyers grant Australia wide is usually paid once the sale of the new property has been completed. If you are building your own property (or have contracted with a builder to do it for you), then the money will be paid once construction has started (this is usually once the foundations have been laid).

About The HomeBuilder Grant program

The HomeBuilder Grant is a nationwide stimulus package that has been formulated as a response to the economic hardship from COVID-19. The grant will apply to both renovations and new homes, and will total $25,000.

For new homes, the property value cannot exceed $750,000. Renovations cannot exceed $150,000 and cannot include pools or tennis courts. Singles must be earning $125,000 or less based on their tax return, and couples must have a combined income of less than $200,00.

Find more information here.

About the 2020 Building Bonus grant

In an effort to stimulate the WA residential housing market and construction industry, the WA government has released its plan to further compensate those planning to buy or build their first home. This can be applied to contracts to build a new home or contracts to purchase newly built home as part of a single-tier strata scheme.

The Building Bonus Package entitles eligible parties to a payment of $20,000, provided that all requirements are met.

The beauty of this grant is that it does not disqualify you from any other home builder grants that are available in WA. There is now the potential for eligible parties to receive up to $69,440 in State and Commonwealth grants, including the First Homebuyers Grant, HomeBuilder grant, the first home buyer transfer duty concession and now the new Building Bonus grant.

The criteria for building a new home include:

- The home will be constructed as a detached residence, without sharing walls with any other structure. It must also be constructed for the purpose of long-term residence and cannot be for commercial or mixed use.

- The land must be vacant. If you are planning on demolishing an existing structure, The grant will be paid once demolition is completed.

- The contract must be in the name of the land’s registered owner.

- Construction must begin between June 4 2020 and 31 December 2020. Applications are open until 30 June 2021 and can be placed once foundations have been laid.

The criteria for purchasing a new single-tier strata scheme home includes:

- The construction of the home must conform to section 3(1) of the Strata Title Act 1985.

- The development cannot be a multi-tiered construction.

- The contract cannot be for a completed dwelling, held by either developer or third-party.

- Renovations and remodels are not covered under the grant.

- You must enter into the contract between the dates of June 4 2020 and December 31 2020. Construction must commence within six months of the date in which you enter the contract. Apply once ownership has been transferred to you at the completion of construction.

More information about the Building Bonus grant

- You do not have to live in the constructed dwelling to receive the grant, which contrasts with some of the other home builder grants available in Western Australia.

- This grant is available multiple times, provided all criteria is met and the homes are on separate land titles.

- You do not need to be living in WA to access this grant, but construction must be in WA.

- This grant does not include any means testing or property value capping. They will not test your income or limit the value of the properties included.

Read more from the WA Government’s official announcement here

About the 2020 First Home Loan deposit scheme

The 2020 First Home Loan Deposit Scheme began on January 1st 2020. This scheme was formulated to encourage new home buyers through financial incentive. The scheme allows you to purchase a new home with reduced fees, while only requiring a deposit of 5% of the value of the property.

Banks and lenders usually take out Lender’s Mortgage Insurance (LMI) when a new loanee doesn’t have a 20% deposit ready to go, which incurs extra fees.

As part of this scheme, the government underwrites your loan so that LMI fees don’t apply, and you only need a 5% deposit to start your home building journey.

In Western Australia, the value of the property cannot exceed $400,000 in metro areas and $300,000 in the rest of the state. Read more about this national scheme here.

Home Designs for First Home Buyers

Here at G.J. Gardner Homes, we are known for our quality home designs created to suit your unique lifestyle. From acreage to narrow blocks, our home designs are created to get the most out of your block of land, with everything from natural lighting to north-facing orientation kept in mind during the design process. Check out a just a few of our favourite first home buyer home designs below.

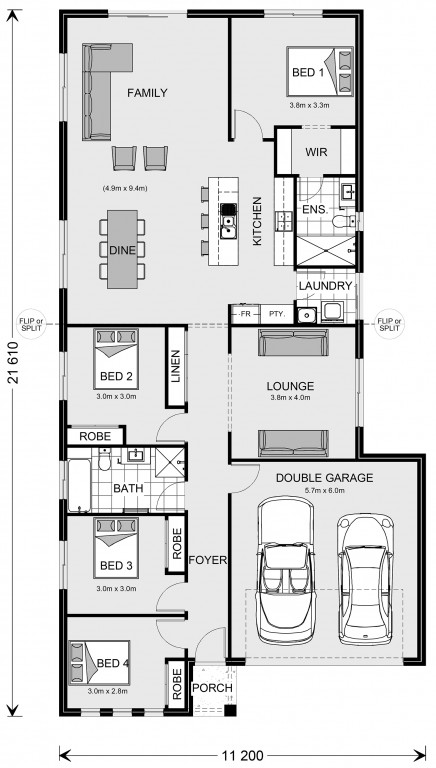

Edgecliff 207

Broadwater 283

Kuranda 289

Check out more home designs, ideal for first home owners here.

The information contained in this article is not legal or financial advice and should not be relied upon as a substitute for professional advice. Consumers should make their own independent inquiries and consider the need to obtain any professional advice relevant to their circumstances. Further information about the First Home Owners Grant is available at http://www.firsthome.gov.au/.