First Time Builder

First Home Owners’ Grant Victoria

With median house prices rising across Victoria, the First Home Grant is an opportunity for new homeowners in Victoria looking for financial support in entering the property market. The following guide will help you assess whether you’re eligible and walk you through the most asked questions about applying and the overall process.

Quick Links

About the First Home Owners’ Grant Victoria

Whether you’re buying your first property or building on an existing home, the Victorian First Home Owners’ Grant is a great form of financial support. To be eligible to receive the $10,000 the First Home Owners Grant, you need to be buying a new property valued up to $750,000 that has never been lived in OR be building a new property valued up to $750,000.

As the Victorian State Revenue Office explains, a first home can include “a house, townhouse, apartment, unit or similar, but it must be valued at $750,000 or less, be the first sale of the property as residential premises, and the home must be less than five years old”.

Grant Eligibility

So if you’re unsure if you qualify for the First Home Owners Grant, we’ve compiled this list to help you work out whether you’re eligible.

According to the Victorian State Revenue Office, if you or your spouse/partner have previously received the new homeowners grant, you are not able to apply a second time. If either of you have been the owner of a house or residential property within Australia prior to 1st July 2000, you are also not eligible for the grant. You are also not able to receive the first home owners grant if you have occupied, for a consecutive period of at least six months, a house in Australia that either of you owned partly or fully on or after 1 July 2000.

Additionally, to receive the FHOG, at least one applicant must:

- occupy the home as their principal place of residence (PPR) for at least 12 months, commencing within 12 months of settlement or completion of construction

- be aged 18 or over (discretionary)

- be an Australian citizen or permanent resident

New Zealanders holding a special category visa under s32 of the Migration Act 1958 and anyone holding a permanent visa under s30(1) are considered permanent residents for these purposes. New Zealand citizens must be living in Australia when the eligible transaction is completed.

Finally, if you’re still unsure, you can also head here to complete the Victorian government’s online assessment to work out if you qualify for the grant: https://www.sro.vic.gov.au/content/will-i-be-eligible-first-home-owner-grant

Applying for the First Home Owners’ Grant

Once you’ve worked out if you’re eligible for a new home owners’ grant, you next need to provide evidence to prove that you are a first-time home owner and that you meet the new home owners grant requirements. You’ll then need to complete and lodge your application on the Victorian government’s website.

What’s important to note is that in most cases, a government-approved agent will lodge the application on your behalf. Approved agents include most major banks as well as credit unions. The process is far simpler when going through an agent. We recommend only lodging your application directly with the State Revenue Office if you are unable to go through an agent.

Find out how to apply for the First Home Owner Grant on the State Revenue Office website.

Victorian Homebuyer Fund Shared Equity Scheme

Victorian Homebuyer Fund’s Shared Equity Scheme For individuals facing challenges in accumulating a home deposit, the Victorian Homebuyer Fund offers a potential solution to expedite homeownership.

With a 5% deposit, the Victorian Government is prepared to contribute up to 25% of the purchase price, acquiring a corresponding share in the property. This arrangement not only diminishes your mortgage but also eliminates the need for Lender’s Mortgage Insurance.

Do First Home Buyers Pay Stamp Duty in Victoria?

In Victoria, if you buy off the plan, you only pay stamp duty on the land the property is sitting on. However, the Victorian Government has removed or reduced stamp duty for first home buyers acquiring a property valued at $600,000 or less. For those purchasing a home between $600,000 and $750,000, the Victorian Government has implemented a gradual reduction in stamp duty. It commences at zero for a $600,000 property and increases incrementally as the home costs $750,000.

Young Victorian farmers remain eligible for a stamp duty concession when acquiring their first farm, a policy upheld by the Victorian Government. The management of stamp duty considerations for first home buyers is overseen by the State Revenue Office, acting on behalf of the Victorian Government.

Victorian First Home Buyers Super Saver Scheme

The First Home Super Saver Scheme provides an opportunity to accelerate your savings within your superannuation, benefitting from favourable tax treatment within the super fund.

You can contribute extra funds, either concessional (before-tax) or non-concessional (after-tax), to your superannuation and withdraw up to the annual cap of $15,000 and a cumulative limit of $50,000. This cap applies individually, allowing couples to save up to a total of $100,000. Learn more about the FHSS.

Homebuyer Fund Victoria

The Victorian government supports eligible homebuyers through the Homebuyer Fund, contributing up to 25% of a property purchase in a shared equity scheme. While this program is not directly accessible through a broker, we can facilitate connections with participating lenders. With various offerings available, there are substantial savings for first home buyers to leverage. You might even be eligible to capitalize on all these incentives!

FAQS

Does the First Home Owners Grant Count Towards a Deposit?

Yes, you may use the grant towards a deposit. What’s important to remember is that the grant may not be enough to make up the whole deposit but rather, will partially contribute to your deposit.

Can You Use the First Home Owners Grant to Buy Land?

Yes. You may use the first home owners grant to buy land, however, in order to be entitled for the grant in the first place, you must have property of your own that is either an existing home or a piece of land you intend to build on. It’s also important to remember you must have occupied that home for at least 12 months and that the home is located within Victoria or regional Victoria.

Can You Get the First Home Owners Grant If You’re Married?

Yes. You are entitled to the first home owners grant. Both sole property owners and owners in a partnership where you and your spouse/partner own the property together are entitled to the grant. Being married does not influence whether you are entitled to the grant or not.

Can Permanent Residents Get First Home Owners Grant?

Yes, permanent residents are entitled to the first home owners grant as well as Australian citizens.

Can You Get The First Home Owners Grant Twice?

No. If you have applied for the first home owners grant and received it already, you are not entitled to apply for it a second time. You are only eligible to receive the first home owners grant once.

Can You Get First Home Owners Grant On Existing Homes?

Yes. You are entitled to receive the first home owners grant if you have owned, for at least 12 months, an existing home. You must also ensure that you meet the other eligibility requirements, including that you are either a permanent resident or Australian citizen and that the existing home is based within Victoria or regional Victoria.

When will I receive my grant payment?

If you’re wondering when you will receive your grant payment after applying, the date will depend on whether you are buying or building a home. For those buying their first home and lodging their application through an agent, the grant will be paid on the date of settlement. If you’re lodging directly with the State Revenue office, within ten working days, the application will be reviewed, and if accepted, the grant will be paid into the account of your choice. For alternate circumstances, we advise having a look at this page for further information on payment dates:

Home Designs for First Home Buyers

Here at G.J. Gardner Homes, we are known for our quality home designs created to suit your unique lifestyle. From acreage to narrow blocks, our home designs are created to get the most out of your block of land, with everything from natural lighting to north-facing orientation kept in mind during the design process. Check out just a few of our favourite first home buyer home designs below.

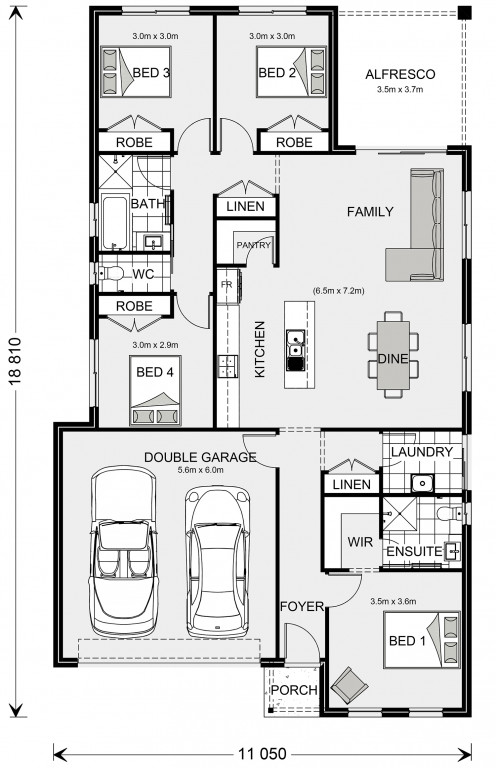

Nova 190

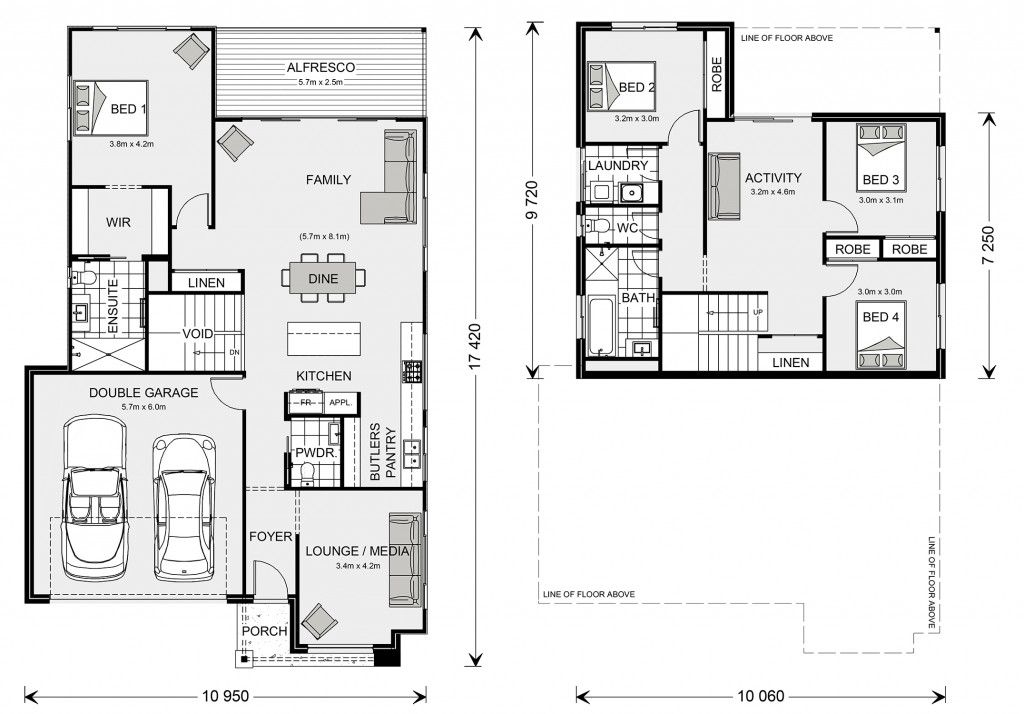

Inglewood 253

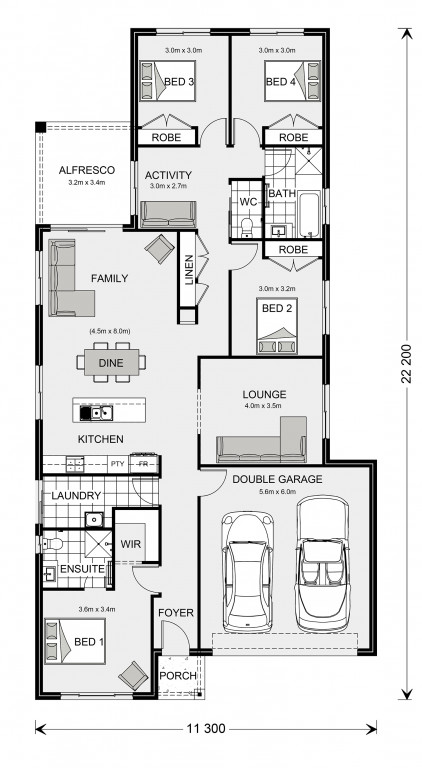

Pacific 210

Are you a first home buyer in Victoria? Meet our team of experienced home builders in Melbourne and surrounds. Our friendly team will be able to help you start building your dream home. In the meantime, check out more home designs ideal for first home owners here.

The information contained in this article is not legal or financial advice and should not be relied upon as a substitute for professional advice. Consumers should make their own independent inquiries and consider the need to obtain any professional advice relevant to their circumstances. Further information about the First Home Owners Grant is available at http://www.firsthome.gov.au/.

Learn more about the First Home Owners Grant in each state: