First Time Builder

First Home Owners’ Grant Australian Capital Territory

Rising house prices and a shortage of housing nationally means that buying a first property in Australian Capital Territory (ACT) can be almost impossible for first-time buyers. In efforts to redress this situation, the government has come up with a number of different initiatives designed to ease the financial burden on first-time buyers, making it easier for them to begin their property ladder climb.

If you’re a first-time buyer considering a property purchase in ACT, this guide is for you! Read on to find out more about the first home owners’ grant, as well as other concessions for first-time buyers.

Quick Links

- About the First Home Owners’ grant

- About The 2020 First Home Loan deposit scheme

- About The HomeBuilder Grant program

About the First Home Owners’ Grant

How Does The First Home Owners’ Grant Work?

The first home owners’ grant ACT residents can take advantage of is a one-off payment of $7,000 (as at the time of writing). It can be used against the purchase price of a new-build property or one that’s been significantly renovated or remodelled.

New-build properties include ones constructed by a developer, properties that haven’t yet been built (off-plan purchases) or properties which owners are building themselves (or commissioning a builder to build for them). Note that an existing property needs to be extensively renovated before it will be eligible – small-scale renovations aren’t normally eligible for first time home buyer grants.

Properties must not cost more than $750,000 to purchase in order to be eligible for the grant. To get the ball rolling, applicants need to check that they are eligible in principle to apply (check here for the full list of criteria), then fill in a first home buyers’ grant application form. Once submitted, the government will then make a decision on whether your application is successful or not.

How much is the First Home Owners’ Grant in ACT?

The Australian Capital Territory first home buyers’ grant is $7,000. Other states have higher grant levels ($10,000 in Queensland and NSW, for example). This broadly reflects the fact that properties in ACT are less expensive than in some other states (although obviously there are exceptions).

Eligibility

What would make me ineligible for the First Home Owners Grant?

The eligibility criteria are as follows:

- Applicant(s) must not have owned a home previously in Australia.

- Applicant(s) must be over 18.

- Applicant(s) must be Australian nationals or have an appropriate visa – residents with temporary visas are not eligible, for example.

- The property must cost less than $750,000 and be new-build or heavily renovated.

- You must move into the property within 12 months of purchase and live there for at least a year afterwards.

Applying for the First Home Owners’ Grant

How do I apply for the First Home Owners’ Grant?

In the first instance, you will need to fill in the first home owner’s grant application form and submit it.

FAQS

Is the First Home Owners’ Grant still available in ACT?

The first home buyers’ grant Australia wide provides a welcome addition to home buyers’ finances. At the time of writing it is still available in ACT, as well as in the other states. Unfortunately, the future of the grant can’t be guaranteed: annual budgetary pressures mean that the amount may vary in the future, or the grant may be discontinued on a temporary or permanent basis. Once you have identified the property you intend to purchase, you should apply for the new home owners’ grant. Unlike the purchase of an existing property, new-build properties don’t have the problems of property chains or owners changing their mind about selling at the last minute!

When does the First Home Owners’ Grant end in ACT?

Currently, there are no plans to end the government grant for first home buyers: that said, it can’t be guaranteed that an end date won’t be specified in the future.

Does the First Home Owners’ Grant count towards a deposit?

Yes, it can count towards a deposit. Check with your home loan provider, as some won’t accept the grant as part (or all) of a deposit, due to the timing of its payment. It’s also unlikely that $7,000 will be sufficient for a deposit on a new-build property: you will usually need to have savings as well to make up the shortfall.

Can you use the First Home Owners’ Grant to buy land?

No, government grants for first home buyers can’t be used towards the purchase of land. If you are buying land to build a property on, however, it’s possible to get stamp duty relief (relief on conveyancing tax). At the time of writing, if you buy land to build a home on that costs less than $281,200, you will not have to pay stamp duty, provided the combined income of all applicants is less than $160,000 pa. Stamp duty on more expensive land purchases then increases gradually, depending on price. A full breakdown is available here.

Can you get the First Home Owners’ Grant if you’re married?

Yes! Provided you meet the other eligibility criteria.

Can permanent residents get First Home Owners’ Grant?

Yes! Permanent residents can get the first home grant, provided they meet all the other eligibility criteria.

Can you get the First Home Owners’ Grant twice?

No! This is a one-off payment. You cannot apply for a second grant. If you have previously been a home owner, in some circumstances you may be eligible for the grant, provided you haven’t claimed it before.

Do First Home Buyers pay stamp duty in ACT?

It depends on the value of the property you wish to purchase! ACT does offer concessions on stamp duty (conveyancing tax): applicants who are buying a new-build property for less than $470,000 pay no stamp duty. Between $470,000 and $607,000, stamp duty is paid on a sliding scale. No concessions are offered above $607,000. Note that applicants must have a combined income of less than $160,000 annually to be eligible for stamp duty concessions. The stamp duty relief is available on new-build properties only. At the current time, existing properties, even those which have been significantly remodelled, aren’t eligible.

Can you get First Home Owners’ Grant on existing homes?

The first home buyers’ grant existing property rules are a little vague: a property needs to have been “significantly renovated”. This usually involves a change of use (for example converting a commercial building into a residential one), bringing a derelict building into use or converting a much larger residential building into apartments. It’s helpful to remember that one of the aims of the home owner grant scheme is to stimulate the new-build market: this means that commonplace renovations (for example building an extension) will not be eligible.

When does the First Home Owners’ Grant get paid to successful applicants?

For new-build properties constructed by a developer, the grant is paid once the purchase is complete. Home owners who are choosing to build their own home can obtain the grant once work has begun on construction (this is normally considered to be once the foundations have been laid). The timing of the payment is important if you’re considering using the grant as part of your deposit.

About The 2020 First Home Loan deposit scheme

The 2020 First Home Loan Deposit Scheme allows first home buyers to take out a mortgage with significantly lower fees, with a deposit only 5% of the value of the property being purchased. Banks and lenders usually require 20% of the property’s value as part of a deposit to be exempt from Lender’s Mortgage Insurance (LMI) fees.

The federal government will underwrite the loan and act as your guarantor so that LMI fees do not apply. The scheme essentially makes it easier to be approved for a home loan without having saved as much money, while providing financial assistance to new home buyers.

High-value properties are not eligible under the scheme, with only ‘entry properties’ considered. The price limits vary by state and region, but in the ACT there is a cap of $500,000. Read more about this national scheme here.

About The HomeBuilder Grant program

The HomeBuilder grant is a nationwide stimulus package that has been created to respond to the hardships caused by COVID-19. The grant can be applied to both renovations and new homes, and totals $25,000. This is a truly exciting grant for those wishing to break into the housing market!

To be eligible there are some stipulations to be aware of. For new homes, the property value cannot exceed $750,000. Renovations cannot exceed $150,000 and the pre-renovation house value can’t exceed $1.5m. Renovations also can’t include pools or tennis courts. Singles must be earning $125,000 or less based on yearly income, and couples must have a combined income of less than $200,000.

Read more from the Federal Government here.

Home Designs for First Home Buyers

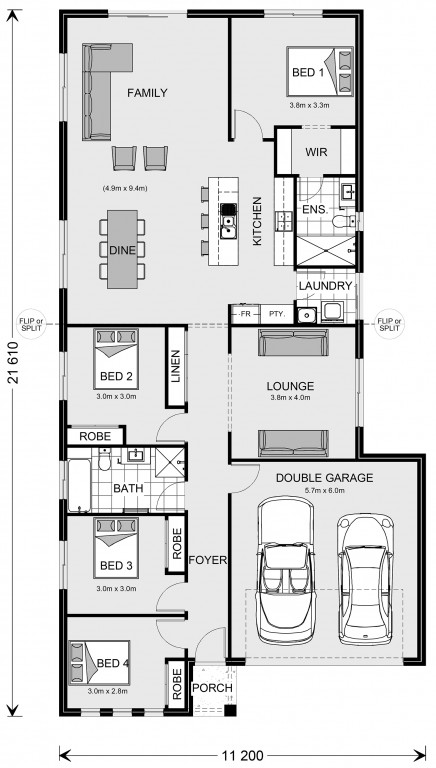

Here at G.J. Gardner Homes, we are known for our quality home designs created to suit your unique lifestyle. From acreage to narrow blocks, our home designs are created to get the most out of your block of land, with everything from natural lighting to north-facing orientation kept in mind during the design process. Check out a just a few of our favourite first home buyer home designs below.

Edgecliff 207

Broadwater 283

Kuranda 289

Check out more home designs, ideal for first home owners here.

The information contained in this article is not legal or financial advice and should not be relied upon as a substitute for professional advice. Consumers should make their own independent inquiries and consider the need to obtain any professional advice relevant to their circumstances. Further information about the First Home Owners Grant is available at http://www.firsthome.gov.au/.

Learn more about the First Home Owners Grant in each state: